According to Visa Business and Economic Insights, U.S. consumers plan to spend an average of $736 on holiday gifts in 2025, which is about a 10% increase from the $669 they reported in 2024.

That’s a lot of festive spending, and honestly, I totally get it. Once the holiday spirit kicks in, it’s so easy to swipe your card a little too often.

Here in the Philippines, we take it to another level. The holiday season starts as soon as the “ber” months hit. Yep, September rolls around, and suddenly malls are blasting Mariah Carey, parols are lighting up the streets, and everyone’s planning Noche Buena. It’s like a four-month celebration! But even here, that early start can mean early spending — and overspending if we’re not careful.

If you want to enjoy the holidays without worrying about credit card bills later, here is a guide full of practical and realistic holiday spending tips.

1. Don’t Fall for Holiday Marketing Tricks

Marketers are way too good at getting us to buy things in December.

Fun trivia: big companies spend billions each year on holiday advertising because they know we’re most emotional — and generous — between Thanksgiving and Christmas.

Ever noticed how stores suddenly smell like cinnamon or peppermint? Or how you get more “exclusive deal” emails right before payday? That’s all planned.

Studies show certain scents and words like “limited-time offer” or “final sale” trigger a sense of urgency, making you spend faster.

To avoid falling for these traps, shop with intention.

- Wait before buying. Leave it in your cart for a day. If you still want it tomorrow, then go for it.

- Turn off promo notifications. Retailers time their deals to hit when you’re most likely scrolling online — usually after dinner.

- Watch out for those “too good to be true” discounts. Some stores hike up prices first just so they can slash them later and make it look like a big sale.

I learned this firsthand when I worked as an Amazon seller VA. Price changes happen all the time, especially before major sale events. It’s one of those marketing tricks brands use to catch shoppers who act fast without checking.

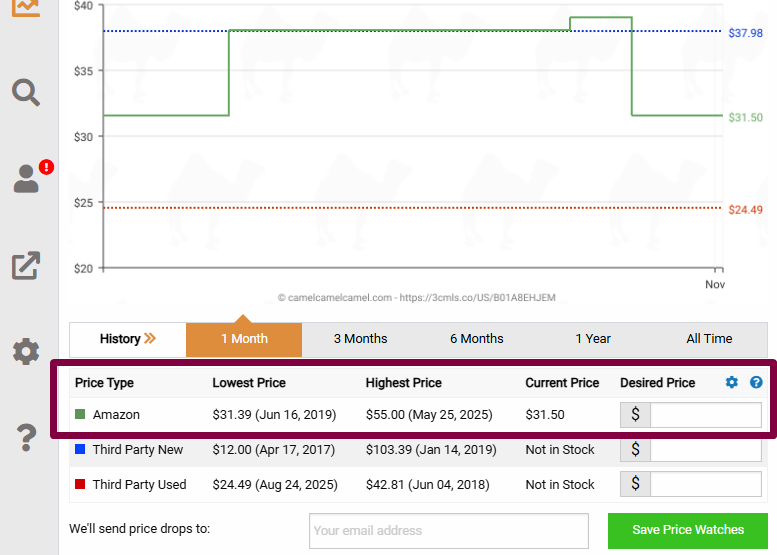

Now, whenever I’m shopping on Amazon, I double-check if a deal is really worth it. I use CamelCamelCamel to track an item’s price history and set a price alert.

When the price drops to my target number, I get an email notification. It’s an easy way to shop smart and make sure those “holiday discounts” are the real deal.

- Don’t shop while stressed. It’s when impulse buying hits hardest.

- And a big one: resist “Buy Now, Pay Later” unless you track it carefully. Those small payments add up faster than you think.

Shop Smart, Not Fast

Holiday sales are everywhere, but smart shoppers know timing is everything.

- Start early. Big discounts appear weeks before the holidays, so shop before everyone else rushes in.

- Compare prices. Use tools like Honey, Rakuten, or CamelCamelCamel for Amazon. They track price drops and offer cashback rewards, so you save without chasing deals all day.

- Watch product reviews and score discounts. Check YouTube reviews before buying — many creators share honest opinions and exclusive discount codes you can use to save more.

- Avoid late-night shopping. Trust me, that’s when you’ll convince yourself your dog needs matching Christmas pajamas.

Shopping smart is not about skipping the fun — it’s about getting what you want without regrets later.

Set a Holiday Shopping Budget You Can Actually Stick To

Before the holiday rush starts, take a good look at your money. Write down your bills, savings goals, and how much you can realistically spend for the season. That’s your holiday shopping budget.

Then, divide it among your list — gifts, food, travel, decor, everything. If the total’s too high, trim it. You can always adjust later, but it’s better to start with a clear limit than to deal with regret in January.

Plan Your Gift List Early

Impulse shopping is powerful, especially when every store is flashing “limited-time holiday deals” in your face. But here’s the thing — planning early always wins. Start by making a list of who you actually want to buy for and set a spending limit for each person. It keeps your wallet safe and saves you from last-minute panic buying.

And let’s be real, you don’t need to buy gifts for everyone you know. Sometimes, we feel pressured to spend just because it’s “expected.”

The truth? Thoughtful doesn’t always mean expensive. A handwritten note, a batch of cookies, or even a small potted plant can mean just as much as a pricey item from the mall.

Avoid Overspending by Setting Simple Rules

Overspending happens when there’s no structure. Try setting small personal rules to guide your decisions. For example:

- No new decor unless you donate or sell an old one.

- Only one “treat yourself” item.

- If it costs more than $50, sleep on it before deciding.

These simple limits keep your spending realistic and your conscience clear.

Choose Thoughtful, Low-Cost Gifts

Homemade or experience-based gifts are both affordable and meaningful. You can bake cookies, create playlists, or put together tiny “care kits.”

Some of my favorite ideas:

- Movie night baskets with snacks and popcorn.

- Small plants or books for quiet gift-givers.

- A coffee date or mini trip instead of a physical gift.

- A planner for someone who loves to organize or set new goals for the year.

Decorate Without Breaking the Bank

Holiday decorating doesn’t have to drain your wallet. Start by reusing what you already have or swapping decorations with friends or family. You can also check thrift stores or local marketplaces for cute secondhand finds that cost way less.

If you want to give your space a fresh look, focus on small, cozy touches like fairy lights, handmade ornaments, or even dried orange garlands. They’re affordable, easy to make, and instantly give your home that festive vibe.

Here’s a little insider tip: the best time to buy Christmas decor is right after the holidays when stores offer discounts of up to 80%. Grab them then and store them for next year. Future you will be so proud of that smart move.

Track Spending and Prevent Debt

Use a budgeting app or simple spreadsheet to see where your money goes. Set alerts for due dates and monitor your holiday spending habits regularly.

If you have credit card rewards or holiday cash back programs, use them strategically. They can reduce your overall spending and make your purchases work harder for you.

The point isn’t to stop celebrating — it’s to spend with purpose so you can start the new year without financial stress.

Don’t Let Social Media Pressure You

Scrolling through Instagram and seeing influencers with perfect Christmas trees and matching pajamas can mess with your perspective. But remember, social media is a highlight reel, not real life.

Take a break if it starts making you anxious. Focus on your own traditions and the people you love. Honestly, the most memorable holidays I’ve had weren’t picture-perfect. They were cozy, messy, and filled with laughter — and not one of them required maxing out my credit card.

You might also like: How to Stop Comparing Finances with Friends (and Strangers Online)

Start Preparing for Next Year

When the season winds down, reflect a bit. What worked? What didn’t? Jot down notes while it’s fresh.

Then, open a small holiday savings fund in January. Even $20 a month adds up. By next Christmas, you’ll have a ready-made budget waiting — no stress, no panic, no last-minute debt.

And there you have it. The holidays can be just as joyful without the overspending spiral. It’s all about being intentional, finding balance, and remembering what really matters — the time spent, not the price tag. Whether your Christmas starts in September or December, you deserve to celebrate freely and financially stress-free.