For a long time, I didn’t really know where my money was going. I wasn’t spending on big or fancy things, yet I often ended up short before payday. I’d ask myself, “Wait, where did all my money go?” That’s what inspired me to start tracking my monthly expenses.

It wasn’t easy at first, but over time, I built a habit that helped me feel more in control of my finances. In this post, I’ll walk you through how I started, what I learned, and how you can start tracking your own expenses too — even if you’re not great with numbers or budgeting.

Step 1: Recognize When It’s Time to Track

My realization started when I began earning ₱25,000 (around $435) per month. Like many Filipinos, I contributed to our household expenses. I thought I was managing my money well, but somehow, I was always short before payday.

I’d often scroll through my e-wallets like GCash, Maya, and various banking apps, trying to figure out where my money went. Most of the time, I couldn’t even remember what I’d spent half of it on. That confusion made me realize I needed to start being more intentional with my finances.

If you’ve ever felt like your money disappears too quickly, that’s your sign to start tracking. It’s not about limiting yourself; it’s about becoming aware of your spending habits.

Step 2: Start Simple (Even if You Fail at First)

According to a Consumer Financial Protection Bureau report, many people find budgeting and tracking expenses overwhelming or time-consuming. I felt exactly the same way when I started.

At first, I wrote my expenses in a small notebook, but I often misplaced it. Then I started using Google Sheets, which worked for a while. You can use it on your phone, but it is not very convenient for quick tracking. I had to open the app, look for the right file, and type everything in. It took too much time, especially when I was outside. I wanted something faster and easier to update.

Next, I tried the Notes app on my phone. It was easier, but I couldn’t categorize my expenses neatly. Eventually, I experimented with different budgeting apps but didn’t like switching between too many platforms.

Then, I discovered Notion, which became my go-to tool. It’s customizable, simple, and has a mobile widget, so I can record expenses in just one tap. I started by creating four basic categories:

- Food – groceries, meals, and snacks.

- Transportation – gas, tolls, parking, fare, and valet.

- Personal – skincare and small online purchases.

- Household – Wi-Fi, electricity, Netflix, Disney+, and my contribution to family expenses.

I intentionally kept the categories short to avoid getting overwhelmed. In the beginning, I didn’t track every single peso — I focused on building the habit. Once it became part of my daily routine, tracking felt natural.

Step 3: Get Serious When Income Grows

As my income grew, I noticed something interesting — the more I earned, the more I spent. This is what many call lifestyle inflation. Even though I had a higher salary, my savings didn’t increase.

That’s when I decided to track my spending more carefully. I started recording all my expenses, even the small ones like coffee runs or delivery fees. These “tiny treats” seemed harmless, but they added up quickly.

When I reviewed my Notion tracker, I realized how big the difference was between my old and current spending habits. It was eye-opening and gave me the motivation to stay consistent.

Step 4: Choose a Tracking Method That Works for You

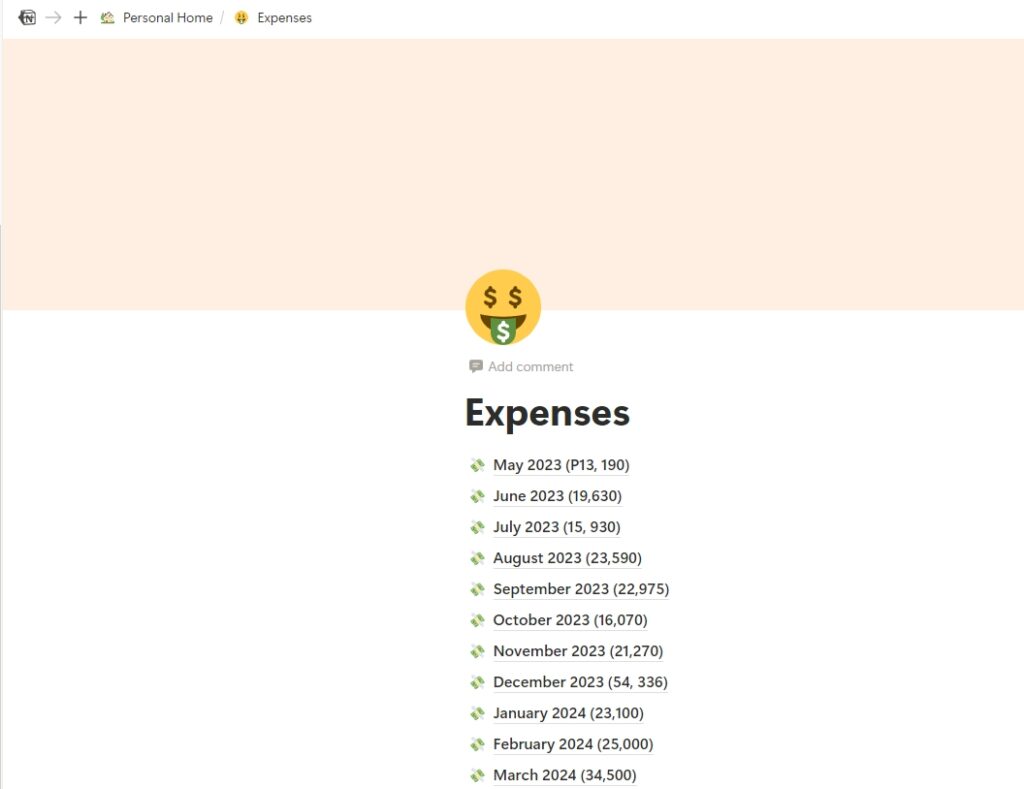

I’ve been tracking my expenses on Notion since May 2023. Whenever I make a purchase, I open the widget, type the amount, select the category, and save it.

When I’m too busy, I keep the receipts in my bag and enter them later at night. At the end of each week, I review everything to see if I overspent in certain categories.

If Notion isn’t for you, there are many other ways to track your spending:

- Spreadsheets – Great for people who like structure.

- Expense-tracking apps – Apps like Mint, PocketGuard, or Goodbudget can automatically sync your accounts and track spending.

- Envelope system – Perfect for cash users. Divide your money into labeled envelopes (food, transport, savings, etc.). You can find these envelopes on e-commerce platforms like Amazon, Shopee, and Lazada.

- Notes app or paper – Ideal if you’re just starting out. What matters most is consistency, not the tool itself.

Step 5: Review and Reflect

After tracking for several months, I learned that small daily purchases can eat up a large part of my budget. My biggest realization? I was spending more on coffee and food delivery than on actual groceries.

As someone who works from home for long hours, I used to “reward” myself with coffee or milk tea — almost every day. Once I saw the numbers, I became more mindful. Now, I set a small “treat budget” each week and try to cook at home more often.

Seeing your data in front of you changes how you view money. It’s no longer about guilt — it’s about awareness.

Step 6: Notice the Change in Your Mindset

Once I built the habit, I started feeling calmer about money. I no longer panic before payday because I already know where my money goes.

Tracking also helped me plan better. I can now set realistic budgets for food, bills, and savings. I even started saving for short trips and small investments.

More importantly, I stopped feeling guilty about spending. When I buy something I truly want, I know it fits within my plan. That’s what financial confidence feels like.

Step 7: Keep It Simple and Stay Consistent

If you’re just starting, don’t overthink it. You don’t need the perfect app or a complicated spreadsheet. Even a note on your phone works fine.

Here are a few simple tips that helped me:

- Start small. Track only a few categories first, like food, transport, and bills.

- Be consistent. Record your spending as soon as possible, or keep receipts to log later.

- Review weekly. Check your totals and adjust your budget if needed.

- Avoid judgment. The goal is awareness, not perfection.

- Celebrate small wins. Building new habits takes time — give yourself credit.

According to a study published on PubMed Central, people who regularly track their expenses develop better financial awareness and self-control, which can lead to improved saving habits and reduced financial stress.

I realized that was true for me too. Once I saw where my money was actually going, I started feeling more in control and less stressed about it.

Final Thoughts

Learning to track my monthly expenses changed the way I think about money. It’s not just about budgeting or cutting costs; it’s about being aware and intentional with how I spend.

If you’re just starting your financial journey, start small. Write down one expense today — that’s all it takes to begin. Over time, this habit will grow naturally and help you understand your money better.

Trust me, when you finally see where every peso (or dollar) goes, you’ll thank yourself for starting.