You’ve probably tried at least three budgeting apps by now, haven’t you? They all promise to change your financial life with colorful charts and push notifications, yet somehow you’re still wondering where your money went at the end of each month. There’s this Japanese budgeting method that’s been around since 1904, and it doesn’t involve a single automated alert or AI-powered insight—just a notebook, a pen, and four simple questions that make you actually think about your spending.

Kakeibo (pronounced kah-keh-boh) translates to “household financial ledger,” and it was created by Hani Motoko, Japan’s first female journalist, who wanted to help housewives manage their household finances with intention rather than restriction. What makes this Japanese saving technique different is that it forces you to write everything down by hand, which sounds tedious until you realize that’s exactly why it works—the physical act of recording each purchase makes you pause and consider whether you really need that third coffee of the day.

How This Japanese Budgeting Method Actually Works

The Kakeibo budgeting system revolves around a monthly ritual that starts before you spend a single penny. You’ll sit down with your Kakeibo journal and answer four questions that frame your entire financial month:

- How much money do you have? This means looking at your actual income after taxes and any fixed costs like rent or insurance—what’s really yours to work with.

- How much do you want to save? You decide this number yourself before anything else, which flips the usual script of saving whatever’s left over.

- How much are you spending? This becomes your daily practice of writing down every single purchase, no matter how small, and assigning it to a category.

- How can you improve? At month’s end, you’ll look back at patterns and honestly assess what worked and what didn’t.

These aren’t just philosophical musings—they’re practical anchors that keep your budget grounded in reality rather than wishful thinking.

Once you’ve set your savings target (and yes, you decide this yourself, which is both liberating and terrifying), you subtract it from your income along with any fixed costs like rent or mortgage. What’s left becomes your spending budget, and this is where the mindful spending magic happens. Every single purchase gets written down, no matter how small, and each one falls into one of four spending categories that give you a clear picture of where your money actually goes.

The Four Categories That Change Everything

Most budgeting systems lump everything into “needs” and “wants,” but Kakeibo budgeting tips suggest this is where people get stuck—they feel guilty about every “want” and never question their “needs.” The Kakeibo categories add nuance that makes conscious spending feel less like punishment and more like understanding yourself.

Needs

Needs cover the obvious essentials—groceries, utilities, rent, and transportation to work. These are the things that keep your life running, though you might be surprised how many “needs” start looking like “wants” once you’re writing them down every day.

Wants

Wants are your optional purchases, the things that bring joy but aren’t crucial for survival. New clothes when your closet is already full, that streaming subscription you forgot you had, dining out when there’s food at home—these all live here. The beauty of this Japanese household accounting method is that it doesn’t shame you for wants; it just makes you aware of them.

Culture

Culture is where Kakeibo gets interesting and distinctly Japanese. This category includes books, museum visits, concerts, art supplies, and educational courses—anything that feeds your mind and soul.

In Western budgeting, these often get lumped with “wants” and cut first, but Kakeibo recognizes that cultural enrichment isn’t frivolous; it’s what makes life worth living.

Unexpected

Unexpected covers those surprises life throws at you—car repairs, medical bills, that wedding gift you completely forgot about until the invitation arrived.

Having a dedicated category for these expenses means they don’t derail your entire budget, and you start to see patterns in what you label as “unexpected” versus what you should probably plan for.

Kakeibo Reflection in Action

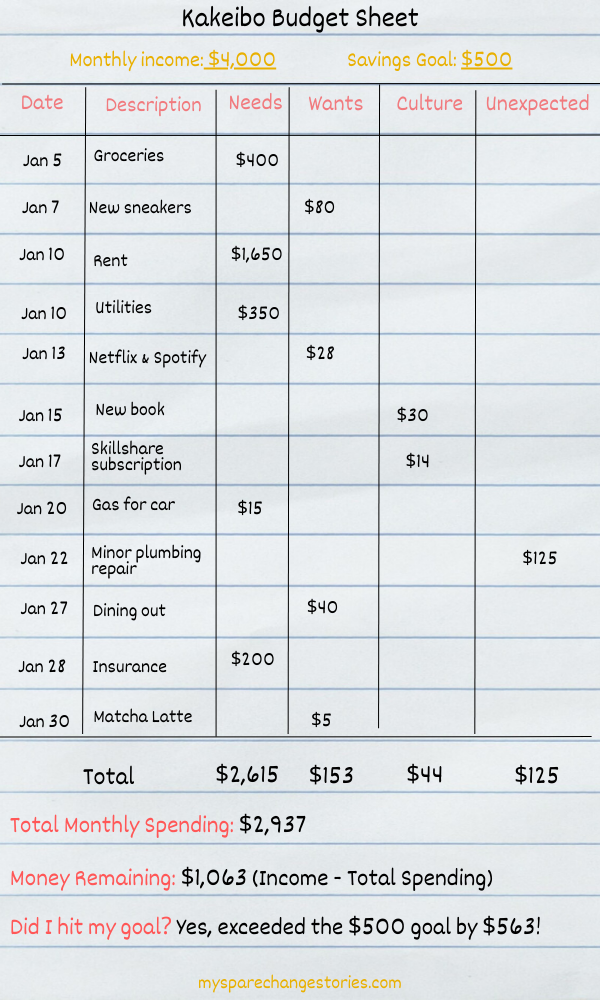

Using the sheet, here’s how the four Kakeibo reflection questions could look in practice, based on the numbers shown.

1. How much money do you have available?

- Monthly income: $4,000

- Savings goal: $500

- Target amount available for spending after savings: $3,500

So at the start of the month, you’re saying, “I have $4,000 coming in, and I want to set aside $500, so I’ll aim to live on $3,500 this month.”

2. How much would you like to save?

- Stated goal on the sheet: $500

- Actual result:

- Total monthly spending: $2,937

- Money remaining: $1,063

So in reality, you didn’t just hit the $500 savings goal—you went past it and ended up with $1,063 left, which is $563 more than you originally planned to save.

3. How much are you spending?

You’re looking at totals by category:

- Needs: $2,615

(Groceries, rent, utilities, gas, insurance) - Wants: $153

(New sneakers, dining out, matcha latte) - Culture: $44

(New book, Skillshare subscription) - Unexpected: $125

(Minor plumbing repair)

Here you’re asking, “Where did my money actually go this month? ” The sheet shows most of it went to needs, a modest amount to wants and culture, and one unexpected hit.

4. How can you improve?

This is where you talk to yourself about patterns you see on the sheet:

- Needs are high but mostly fixed (rent, utilities, insurance), so there may not be much wiggle room there, apart from groceries or gas.

- Wants are relatively low, but you might still ask if the sneakers or dining out felt worth it, or if you’d rather shift a bit of that toward culture or extra savings next month.

- Culture spending is small but clearly intentional (book + Skillshare), and you can decide if that amount feels right or if you’d like to prioritize it more.

- The plumbing repair shows up in Unexpected, which might prompt you to build a small sinking fund for home or repair costs so future months feel less disrupted.

Putting it together, your reflection might sound like:

- “I planned to save $500 and ended up with $1,063 left, so my goal was realistic and maybe even a bit conservative.”

- “Most of my money went to needs, which makes sense, but groceries and utilities are the only real levers I can adjust.”

- “Wants were pretty controlled this month; if I want to free up even more for saving or culture, I could trim one meal out or the matcha habit.”

- “That plumbing repair reminds me I should set aside a little each month for home maintenance so it doesn’t show up as ‘unexpected’ forever.”

That’s the Kakeibo reflection in action: using the four questions to read this one sheet like a story of how you lived and spent over the month.

Who Actually Benefits from This Japanese Budgeting Method

If budgeting apps make money management feel like a losing game, Kakeibo offers a different path. It’s ideal for budgeting for beginners because you start by simply noticing your spending without cutting anything. The manual writing process naturally slows down impulse purchases, giving you space to reconsider.

For anyone dealing with financial anxiety, there’s something calming about putting pen to paper. Your budget journal becomes a personal story rather than abstract numbers on a screen, helping you reconnect with your finances when digital tools have left you feeling disconnected.

The Honest Pros and Cons

What Makes It Work

- The mindfulness aspect is real. Writing by hand forces you to confront each purchase in a way that tapping a card never does.

- The categories make sense culturally and practically, especially that culture category that protects your personal growth spending.

- It’s forgiving—you’re not failing if you overspend; you’re just learning what realistic budgets look like for your actual life.

What Makes It Challenging

- It requires consistency, which is hard when you’re tired and just want to scroll through your phone before bed.

- If you hate writing by hand, this will feel like punishment.

- It also doesn’t automatically calculate anything, so if math isn’t your friend, you might struggle with the monthly reconciliation.

- And in a world where most transactions are digital, remembering to write down that automatic subscription renewal or Venmo payment takes real discipline.

Do I have to use a physical notebook?

Not necessarily. While traditional Kakeibo journals exist and many people love the tactile experience, others use apps designed for this method. The important part is the manual entry and reflection, not the medium.

When Kakeibo Isn’t the Answer

Kakeibo isn’t for everyone, and that’s perfectly okay. If you’re juggling complex investments, multiple income streams, or business expenses, this Japanese household accounting method might feel too simple for your needs.

Other budgeting systems could work better:

- Zero-based budgeting gives every single dollar a specific job, which helps when your finances are more complicated

- The 50/30/20 rule offers a simple percentage-based structure if you want less categorization

- The envelope system provides physical separation of cash for different spending areas

The key is recognizing that Kakeibo isn’t about perfection—it’s about presence and mindfulness. You’re not trying to optimize every penny; you’re trying to understand your relationship with money so you can make choices that align with what you actually value.